Financial literacy is something I wish I had learned more about earlier in life. It’s the foundation for making informed decisions about money, and it’s empowering to take control of your financial future.

One of the first steps in becoming financially literate is understanding the basics of budgeting. For me, budgeting was a game-changer. It’s about knowing where your money is coming from and where it’s going. I started by tracking all my expenses for a month to see my spending habits. It was eye-opening, to say the least. Seeing everything laid out helped me identify areas where I could cut back and save more.

Recently, I started following the 50/30/20 rule, and it’s been incredibly helpful. The rule is simple: 50% of your income goes to necessities, 30% to wants, and 20% to savings and debt repayment. This framework helps me prioritize my spending and ensure that I’m saving consistently. Automating savings can make this even easier—setting up automatic transfers to your savings account so you’re consistently putting money away.

Saving money is a critical component. It’s not just about putting aside what’s left at the end of the month but making saving a priority.

Investing can seem intimidating at first, but it’s essential for building wealth over time. I started by learning the basics—stocks, bonds, mutual funds, and real estate. The key is to start small and diversify your investments. Don’t put all your eggs in one basket. Educating yourself about the different types of investments and understanding the risks involved is crucial. Remember, investing is a long-term game.

Managing debt is also a significant aspect of financial literacy. Not all debt is bad, but understanding how to manage it is vital. High-interest debt, like credit card debt, should be a priority to pay off. Strategies like the debt snowball or debt avalanche methods can help you tackle debt systematically.

Here are some practical tips to enhance your financial literacy:

1.Track Your Spending: Keep an eye on where your money is going to identify patterns and areas for improvement.

2.Set Financial Goals: Whether it’s saving for a vacation, a down payment on a house, or retirement, having clear goals helps you stay focused and motivated.

3.Educate Yourself: Read books, take online courses, and follow financial experts to expand your knowledge.

4.Create an Emergency Fund: Aim to save at least three to six months’ worth of expenses. This fund can be a lifesaver in case of unexpected events.

5.Invest Wisely: Start with small investments and diversify your portfolio. Remember, the goal is to grow your wealth over time.

6.Manage Your Debt: Pay off high-interest debt first and avoid taking on unnecessary debt.

Financial literacy isn’t about becoming an expert overnight. It’s a journey of continuous learning and improvement. By taking small steps every day, you can build a solid financial foundation and take control of your future.

Here’s to mastering our finances and achieving financial freedom!

Updates

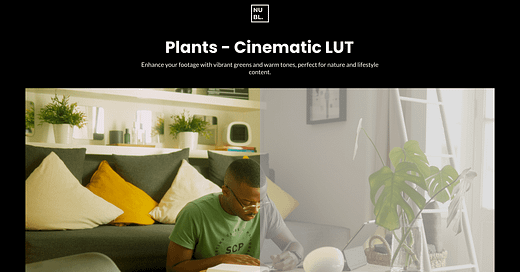

Plants - Cinematic LUT

Just launched my own LUT, available for S-LOG3 and Apple LOG. Get here.

Link Lowdown

A collection of links to stuff I think are worth sharing.

NotckNook - this app have been hyping on social media! Dynamic Island for Macs

Notion - y’all ready know

Daniel Dalen - Been watching this guy on Youtube everyday

The Creative Act - The book I'm currently reading